Under chairman Cho Yong-byoung, the Korea Federation of Banks will focus on enhancing industry ethics and innovation, aiming to combat misrepresentation while fostering trust and transparency

The bank achieved profitability in less than five years, with co-founder and CEO Coen Jonker highlighting the company’s success in South Africa and the Philippines while outlining its expansion strategy in Vietnam and Indonesia

OCBC's Head of Group Data Office, Donald MacDonald, reveals the bank's transformative journey integrating generative AI, exemplifying an inclusive approach, innovative tools like 'Buddy' and 'Wingman,' and a pragmatic focus on tangible…

Industry leaders converged in Seoul to explore the transformative potential of emerging technologies like AI and blockchain, and highlighted the imperative for banks to navigate challenges and seize opportunities for innovation

New Development Bank’s Leslie Maasdorp discussed how the nascent multilateral bank is bridging the gap in infrastructure financing in emerging economies

The metaverse, once the stuff of science fiction, is rapidly becoming a reality with profound implications for the financial services industry and other sectors, and the potential to reshape the world as we know it

Ntoudi Mouyelo-Katoula and team spoke with Emmanuel Daniel about returning to Rwanda to build the Kigali International Financial Centre, and connecting Pan African businesses and fintechs to the global financial system.

Leading fintech entrepreneurs in Uganda spent an evening with Emmanuel Daniel to share how Africa will transform finance to focus on the community.

Krungthai Bank (KTB) utilised its e-wallet, Pao Tang, to transfer government COVID-19 relief funds to over 10 million customers as well as enable payments to merchants and businesses as part of retail and tourism sector support programme.

RadioFinance - Webinars, Live Chats and Audios

View more >In a conversation with Ron Shevlin, a renowned banking thought leader, we delved into how the US banks navigate regulatory challenges amid economic uncertainty and strategic shifts

Greg Palmer, head of strategy and host at Finovate conference series, analyses the developments in the US financial industry, highlighting how intense competition for deposits drives the adoption of fintech among banks, and allows…

The RadioFinance session on the Global Banking Industry Outlook for 2024 provided deep insights into the challenges and opportunities in the banking sector. Leading economists joined the discussion and focused on economic growth prospects,…

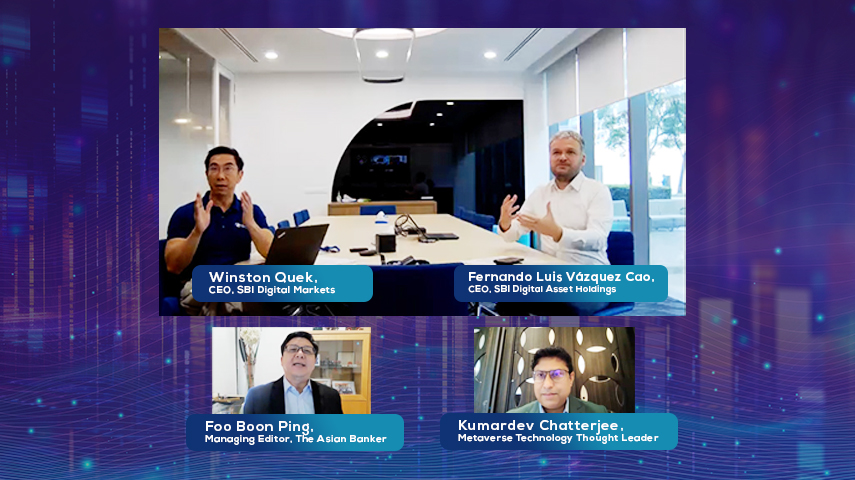

SBI has completed a technical pilot as part of MAS's Project Guardian, diving into asset tokenisation and DeFi, highlighting the importance of regulatory adherence and collaborative ecosystem dynamics

BIDV, Techcombank, TNEX, TPBank, Vietcombank, VietinBank, VPBank and VPBank NEO were recognised for their exceptional performance in retail and digital banking despite a challenging year at The Asian Banker Vietnam Awards 2022.

CEOs and decision-makers of banks across Asia Pacific discussed how the second year of the pandemic has impacted the financial strength and stability of banks.